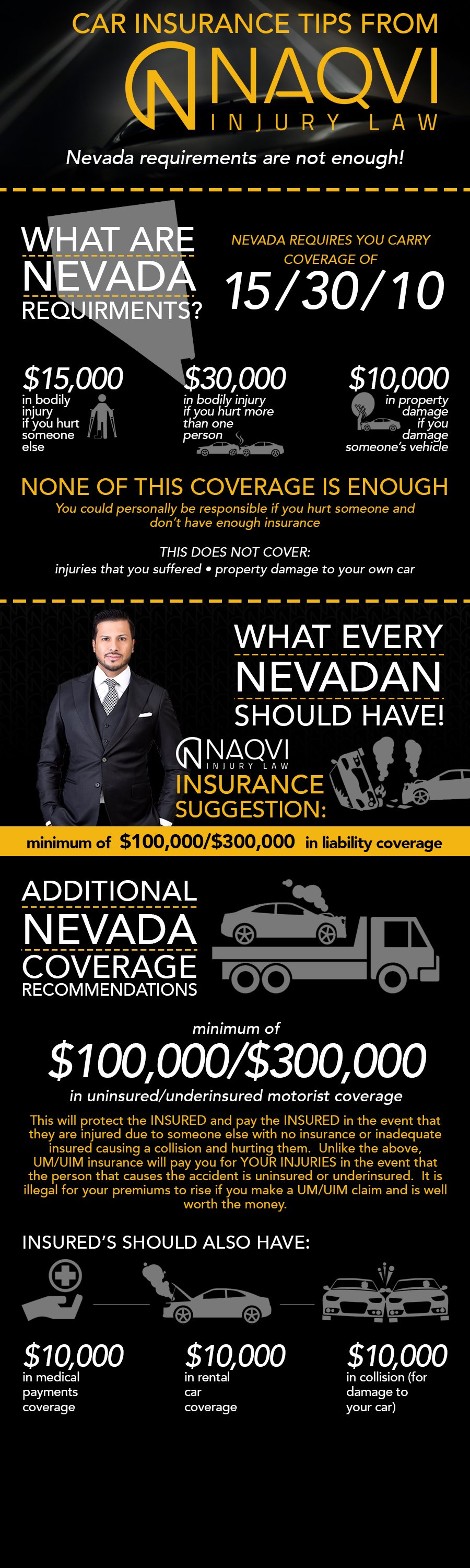

Naqvi Injury Law believes the Nevada requirements for car insurance coverage is not enough! Nevada requires coverage of 15/30/10, which leads to $15,000 in bodily injury if you hurt someone else, $30,000 in bodily injury if you hurt more than one person, and $10,000 in property damage if you damage someone’s vehicle. Keep in mind, this does not cover injuries that you suffered or property damage to your own car.

In Nevada it is illegal for the insurance premiums to go up if they are making an uninsured/underinsured motorist claim. For example, if someone is badly rear-end by someone carrying only a $15,000 policy and the hospital bill alone is more than that, the premium will not go up. In this case, the at-fault driver would be underinsured and the insured’s own UIM coverage will pay the remaining fair value of the claim. Therefore, if the claim is worth $115,000, the insured will get $15,000 from the at fault insurance company’s policy, plus the full amount 100k of the UIM benefits. If the claim is worth $100,000, the claimant will get the full $15,000 from the 3rd party and $75,000 from the UIM benefits.

Farhan Naqvi believes that every Nevadan should have a minimum of $100,000/$300,000 in liability coverage. This will protect the insured and pay the insured in the event that they are injured due to someone else with no insurance or inadequate insured causing a collision and hurting them. In addition, insured’s should also have $10,000 in medical payment coverage, $10,000 in rental car coverage, and $10,000 in collision (for damage to your car).